“Did we ever mention that investing is hard work; painstaking, relentless, and at times confounding? Separating relevant signal from noise can be especially difficult. Endless patience, great discipline, and steely resolve are required. Nothing you do will guarantee success, though you can tilt the odds significantly in your favor by having the right philosophy, mindset, process, team, clients and culture. Getting those six things right is just about everything.

Complicating matters further, a successful investor must possess a number of seemingly contradictory qualities. These include the arrogance to act, and act decisively, and the humility to know that you could be wrong. The acuity, flexibility, and willingness to change your mind when you realize you are wrong, and the stubbornness to refuse to do so when you remain justifiably confident in your thesis. The conviction to concentrate your portfolio in your very best ideas, and the common sense to nevertheless diversify your holdings. A healthy skepticism, but not blind contrarianism. A deep respect for the lessons of history balanced by the knowledge that things regularly happen that have never before occurred. And, finally, the integrity to admit mistakes, the fortitude to risk making more of them, and the intellectual honesty not to confuse luck with skill.”

Seth Klarman, The Baupost Group

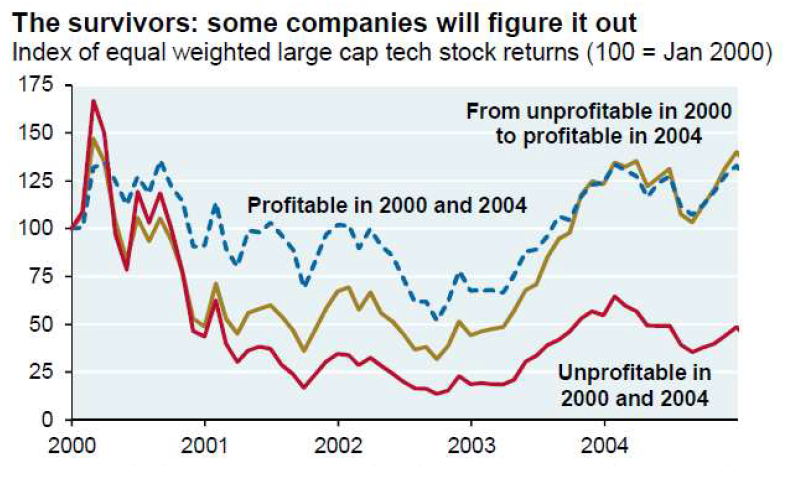

This is an excellent investing quote from a great investor. Excellent because it incapsulates the beautiful and continually evolving challenge of investing. We have chosen this quote to open our 2023 Outlook letter because these lessons are so important today. 2021 was a year in which irrational exuberance won the day as meme stocks and cryptocurrencies left traditional investments in the dust only to crash back to earth similarly spectacularly in 2022. Potentially great companies with important products like Tesla and Netflix did not make good investments because their stock prices had become so divorced from the underlying fundamental prospects of the company for the foreseeable future (a similar fate befell investors into great companies like Microsoft during the dot-com bubble). 2023 will be a year of abundant opportunities, challenges, and dispersion of outcomes across companies and industries. Multiple massive global forces are simultaneously shaping the investment landscape at a pace not seen in several years. The environment should favor the decisive yet humble investor.

2022 Recap

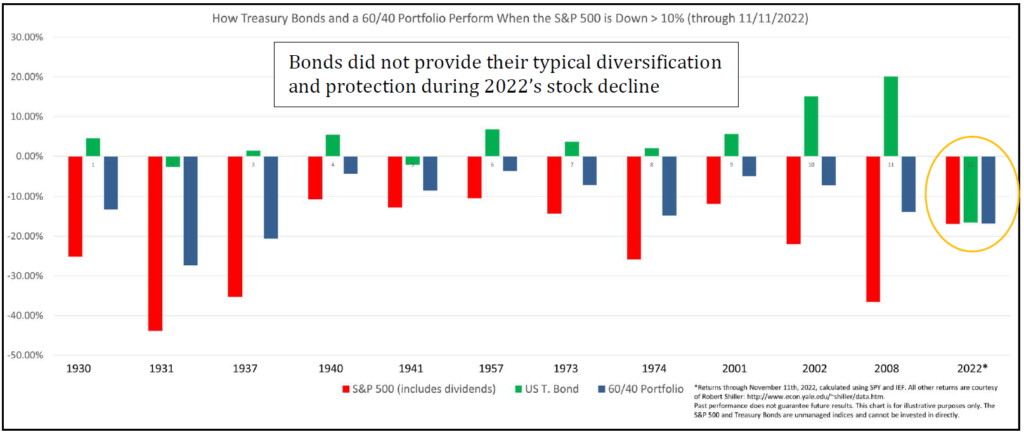

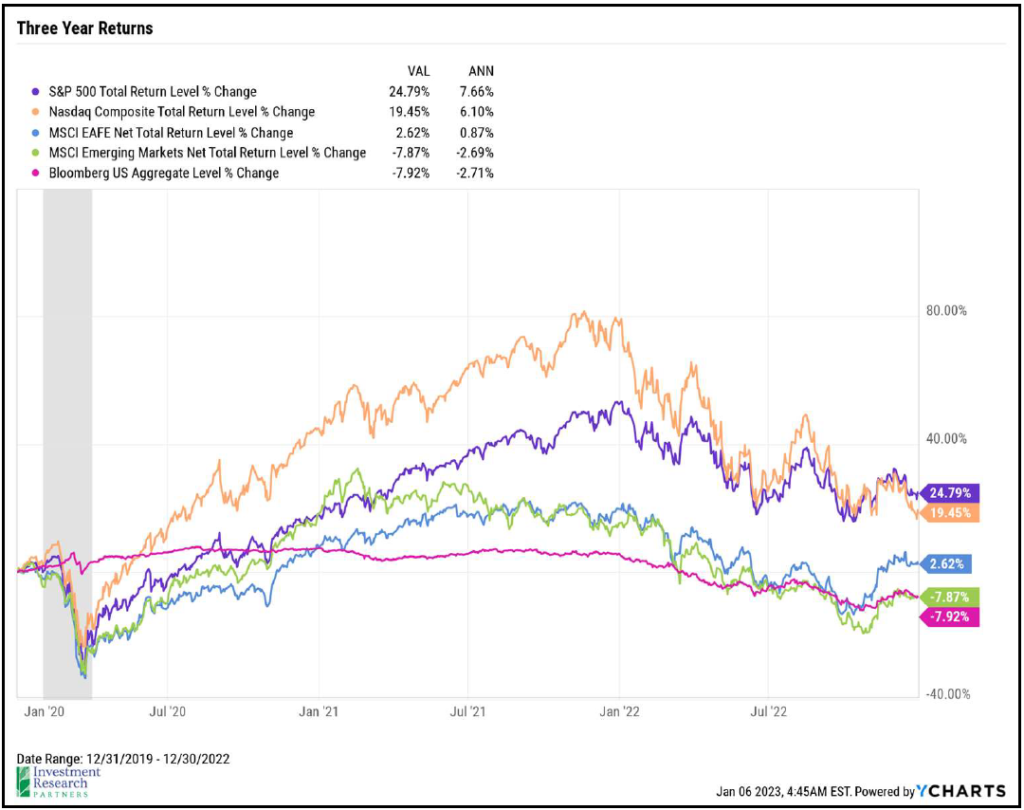

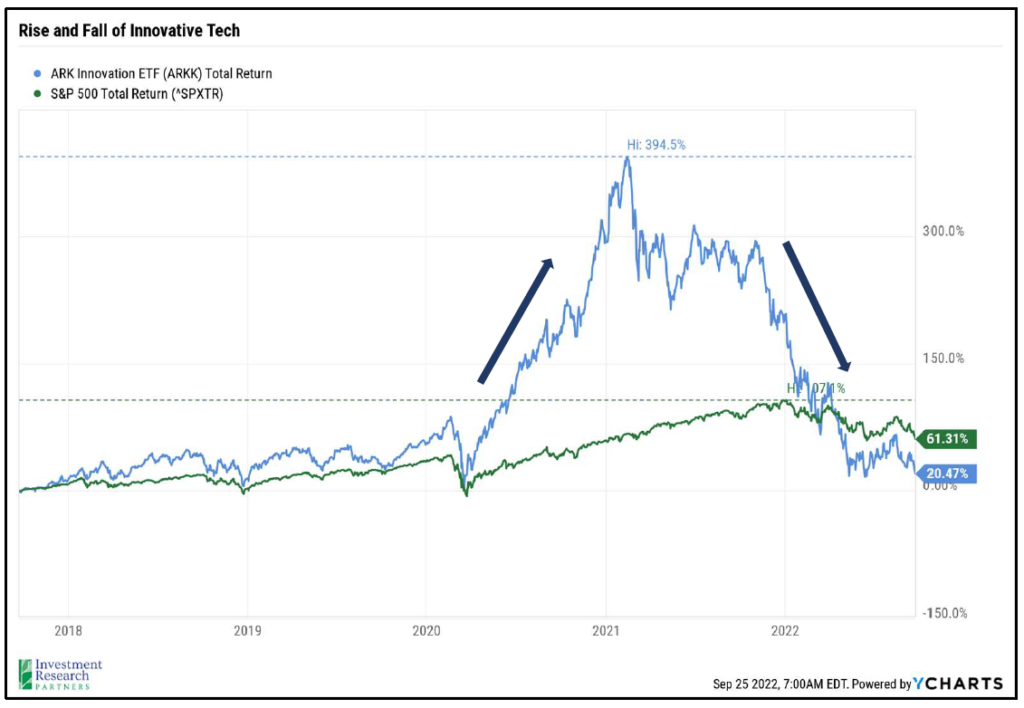

The primary forces weighing on markets last year were inflation, geopolitical issues, and monetary policy. The pandemic continued to echo through the global economy through lock-downs in Asia and supply chain disruptions, which contributed to higher prices (inflation). In the US, the labor market remained very strong and resilient in the face of a potentially slowing economy, but millions of workers left the labor force during the pandemic and have yet to return. For those workers that stayed, wages rose, which is generally a positive thing but this factor also contributed to inflationary pressures. Russia’s war against Ukraine is still causing a massive rebalancing in global commodity markets as those two countries were significant sources of energy, agricultural and industrial metal production (inflationary). In response to these challenges, the US Federal Reserve, which has the dual mandate of promoting full employment and price stability in the economy, was forced to raise short-term lending rates at a much faster pace than originally communicated in an effort to regain price stability (to fight inflation). Their efforts had more immediate impacts on stock and bond prices, sending the S&P 500 down 18% in 2022 and the Barclays Aggregate Bond index down 13% (not to mention more high-flying groups like the NASDAQ, ARK Innovation, and Bitcoin which declined 33%, 67%, and 65%, respectively). The Fed’s efforts also served to raise mortgage rates from below 3% at the end of 2021 to more than 7% by mid-year 2022, which had a swift, chilling effect on housing market transaction activity, but prices have, so far, remained fairly resilient. At the end of 2022, investors are still in a state of limbo while seeking to determine when the Fed will declare victory over inflation and if the Fed’s efforts will plunge the US economy into recession.

2022 Outlook: The Year of Dispersion

We begin the new year with a much-improved outlook for investing as most asset classes are trading for meaningfully more attractive prices than at the beginning of 2022. Many of the issues that plagued capital markets last year are still present as of this writing, and in this piece we will explain why these risks may abate in 2023, which could provide stability for an equity market recovery.

It is important to note that, despite the nearly 20 percent decline in the S&P 500 in 2022, the index notched gains of 18% and 29% in 2020 and 2021, respectively. And, the 10- year return for the index through 2022 was still 12.6% per year. Several factors aligned to allow US large cap equities to embark on such a generous rally, including low starting valuations following the great financial crisis and a decade of very accommodative monetary policy, but also real and humbling innovation that led to above-average revenue growth such as the mass adoption Apple’s iPhone and Amazon’s e-commerce services. The point is; we enter 2023 with conditions more compelling than 2022 but still not as favorable as much of the last decade; however, innovation can always surprise to the upside. And, the S&P 500 is just a part of the global investment opportunity set. Active investors may have the most fertile hunting grounds in years, which we will explain in more detail later.

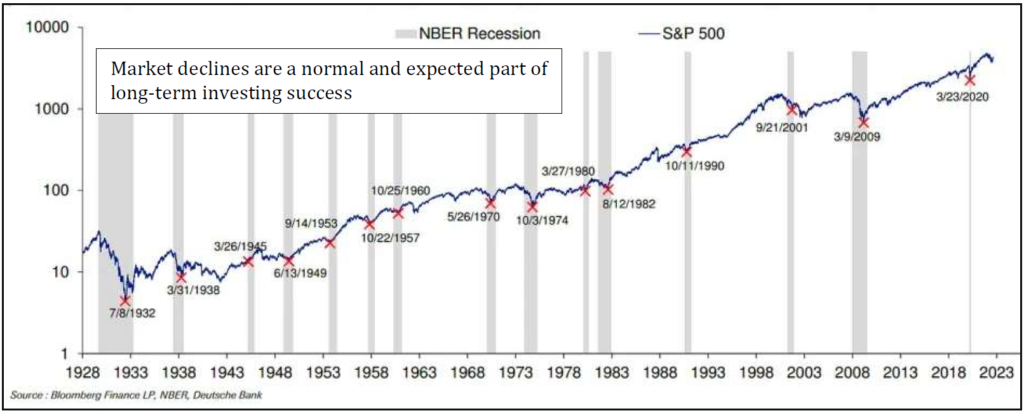

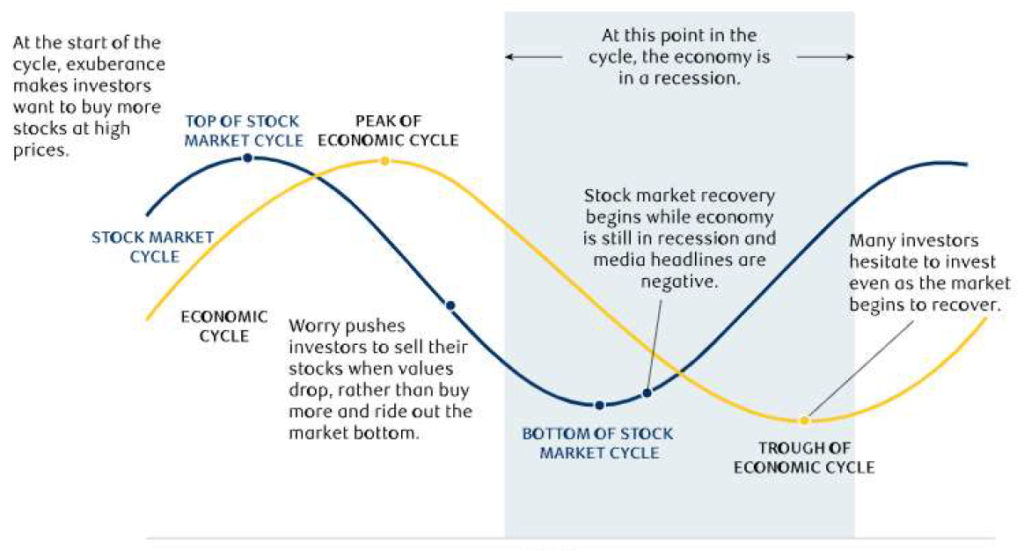

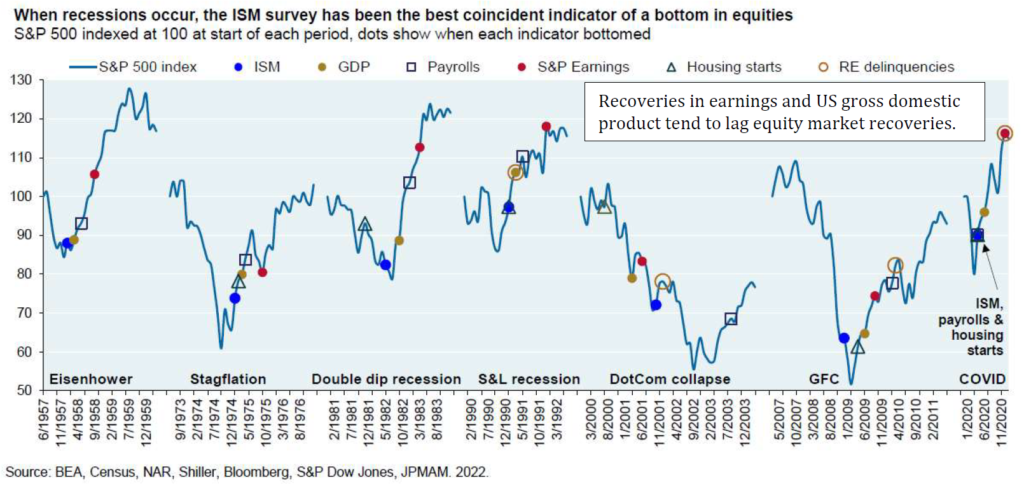

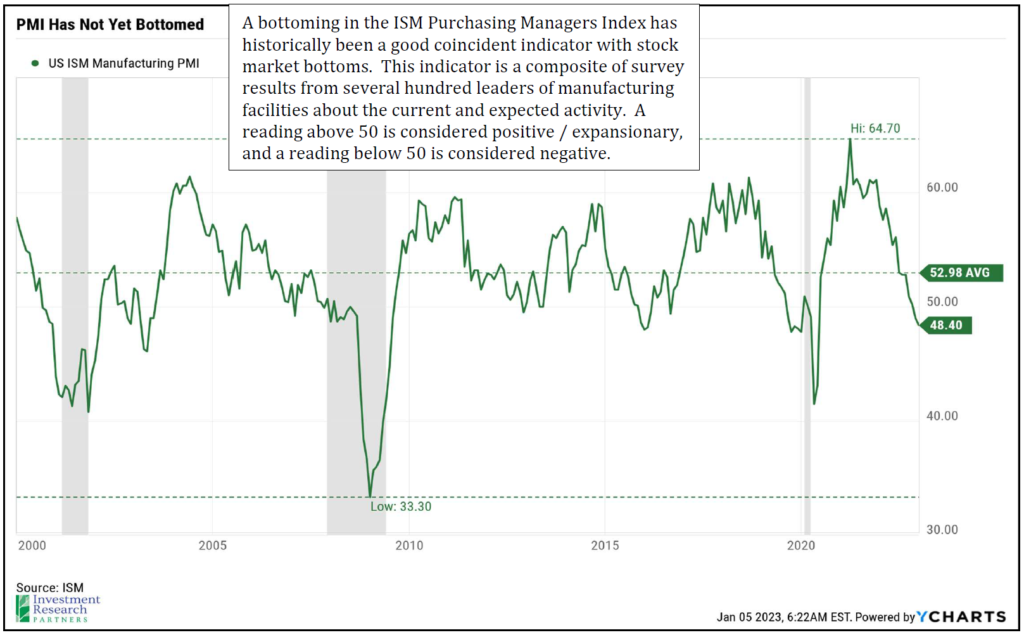

The stock market is not the economy. One of the most challenging elements of investment management may be the disconnect between perceived risks, the economic cycle and investment returns. Harkening back to our beginning quote, this is the “healthy skepticism, but not blind contrarianism.” Because investment markets are priced based on future expectations, they tend to lead the economic cycle (see chart below), though it’s nearly impossible to time when exuberance will turn to pessimism and back again. Inflation, the Federal Reserve, and Putin were the catalysts for reorienting investor sentiment toward negativity last year, and we continue to await the inevitable catalyst toward positivity. In past cycles, positive catalysts have included more compelling valuations, more supportive monetary / fiscal policy, and improving economic growth. All of these are very possible for 2023.

| 2022 Challenge | Potential 2023 Tailwind? |

|---|---|

| Inflation | Most components of Consumer Price Index have begun to decline; supply chains easing, China reopening, wage growth slowing |

| Federal Reserve Policy | Fed already beginning to soften language and pace of rate hikes |

| Geopolitical Tensions | If stalemate persists, Russia may look for off-ramp China does not want to repeat Russia’s mistake, and is very reliant on Taiwan for semiconductors |

| Valuations | Stocks and bonds trading much closer to long-term averages with greater dispersion (more potential for active managers to add value) |

It’s important to note that markets are based on expectations for the future. So, these challenges above may not need to go back to “normal” levels before markets begin to anticipate that and stabilize or recover. In other words, inflation doesn’t need to be 2% again for markets to move higher; inflation just needs to begin consistently trending in the right direction.

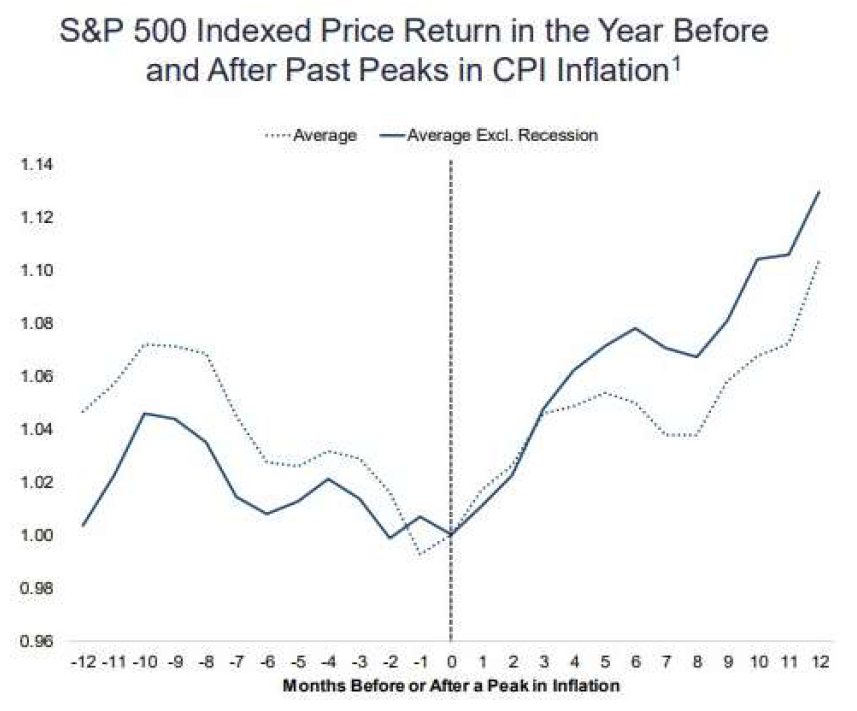

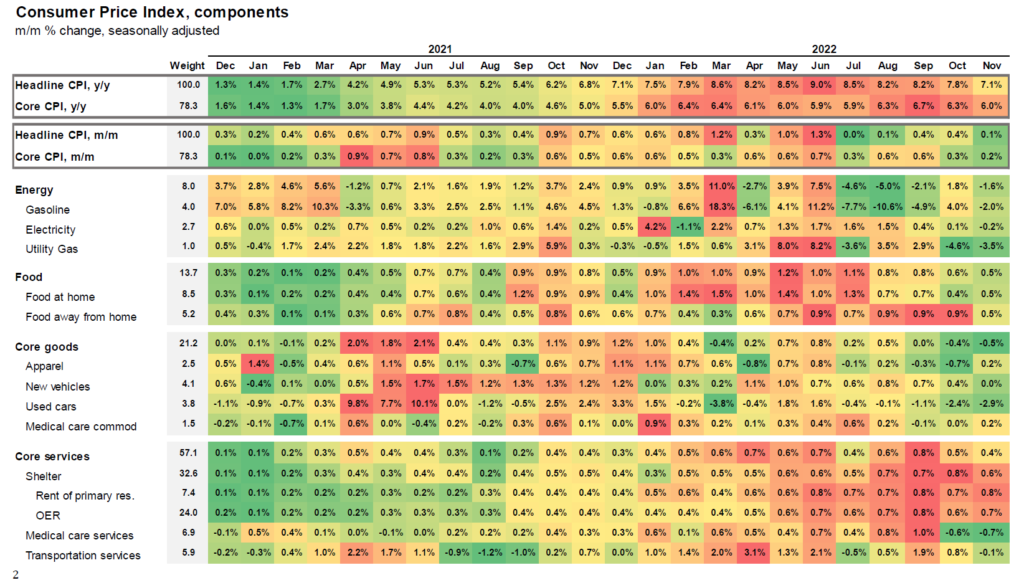

Inflation may have slowed household spending and optimism, but we are seeing signs now of many components of the consumer price index declining such as energy and vehicles. The pace of growth in food, wages, and apparel has also slowed toward more “normal” levels. Elements like energy and vehicles have already begun to outright decline. For example, the national average price for a gallon of gasoline was $3.20 at the end of 2022, which was actually 5% lower than year-end 2021, and down 37% from the peak in June 2022 of nearly $5.11 per gallon. The other big component of CPI is housing, which we expect will start to slow as well as new supply comes online and higher mortgage rates help to better balance a market that had appreciated significantly in the last few years. A more stable price environment tends to be better for markets, and stocks have historically rallied on average after inflation peaks.1

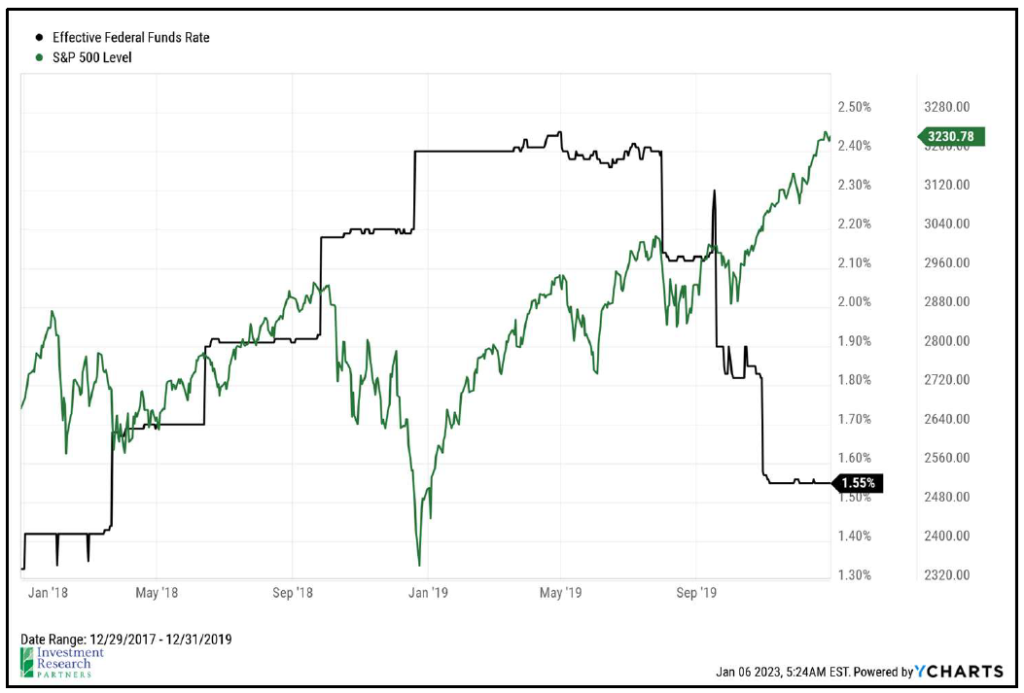

Federal Reserve Policy has been much more restrictive than even the Fed anticipated at the start of the year as the COVID pandemic has lingered in Asia, hampering supply chains, and Russia’s war in Ukraine took the supply of energy and agricultural products offline. The Fed has shown the ability to quickly pivot in the past. The chart below highlights Fed and market activity in 2018 and 2019: the Fed continued to hike rates into a slowing economy, and markets sharply declined 20% into Christmas Eve before the Fed reversed course and markets began to recover. A repeat of this pattern is possible in 2023, though the Fed officials are doing their best (again) to telegraph the institution’s commitment to interest rate increases. Investing when the Fed stops raising interest rates has historically resulted in above-average returns over the next few years, and we anticipate that moderating prices and slowing economic growth will allow the Fed to declare “mission accomplished” in its war on inflation and cease raising interest rates in H1 2023.

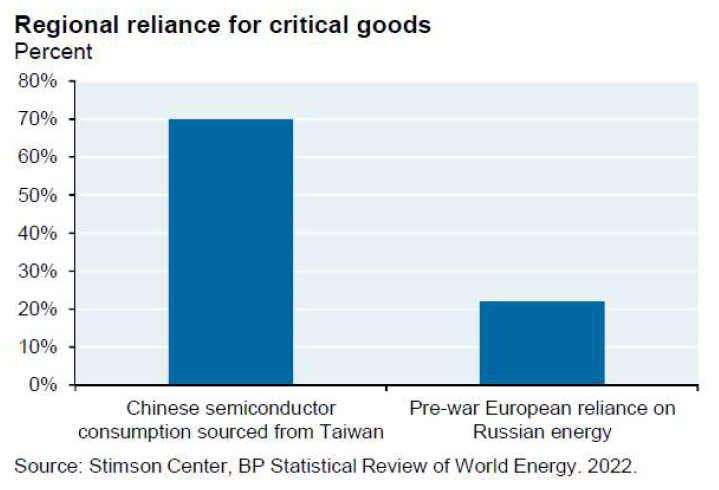

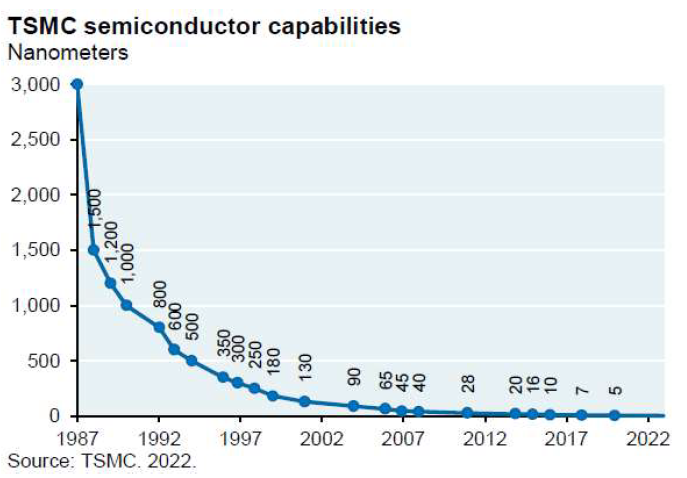

Geopolitical Tensions have been lurking in the background and are exceedingly difficult to anticipate or predict. The obvious issue in 2022 was Russia’s war in Ukraine, but also the prospect of China invading Taiwan and US / China tensions likely had an impact on investor sentiment during the year as well. If the stalemate in Ukraine continues, it would not be surprising for Russia to look for an offramp. Just this week, as Ukraine continues to make advancements in various areas of the conflict, Russia has suggested being open to talks with Ukraine if some territory is conceded. China likely does not want to repeat Russia’s mistakes, particularly as they are dealing with their own health and economic issues at home. China is also extremely dependent on the highly complex semiconductors (computer chips) made by Taiwan Semiconductor which has a near monopoly on producing some of the world’s most advanced chips. An invasion would very significantly damage the ability of China’s economy to function.

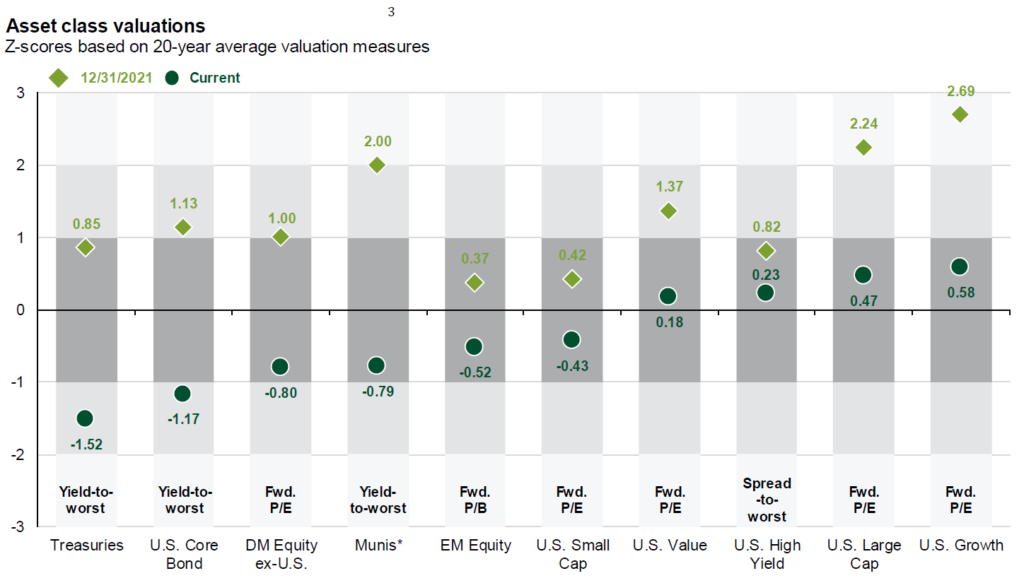

Valuations are much more attractive today than the beginning of 2022 following the year’s declines. Not everything is yet “cheap”, but there is certainly more opportunity for return in almost every part of the market. Some areas like small cap, foreign, and emerging markets already looked attractive and are now even less expensive. Short-term, investment grade corporate bonds yield 5-6% again. This is a big win for savers going forward despite last year’s pain to get there. The chart below uses a statistical measure to standardize how various and differing asset classes are trading relative to their long-term averages. Below zero is cheaper than average, above zero is more expensive than average.

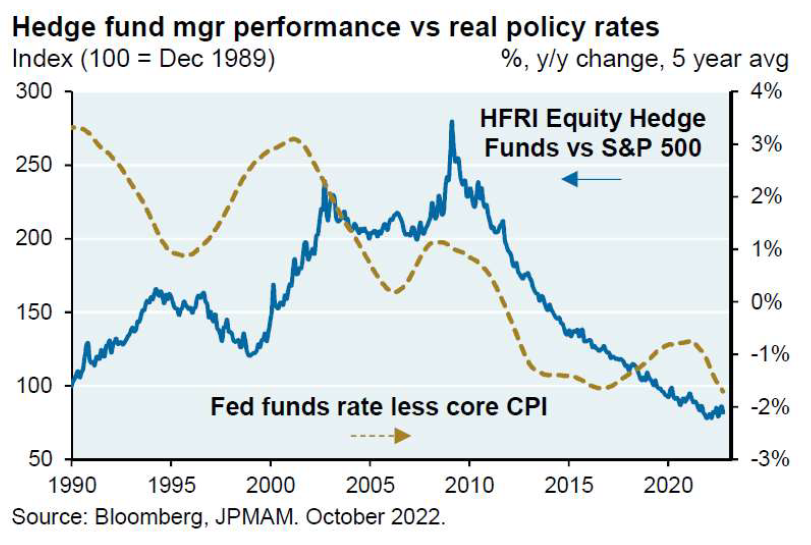

We call 2023 the Year of Dispersion because we anticipate that central banks like the US Federal Reserve will be less of a force and investors will be more focused on the fundamental health and future business prospects for the companies that they own. Similarly, we expect the world to be less synchronized, allowing assets globally to move with significantly lower correlations than we’ve experienced in the last several years. This environment should favor active stock selectors, global asset allocators, and diversified portfolios in general.

Our S&P 500 target for year-end 2023 is 4,000-4,500, which is an expression of our cautiously optimistic view toward markets and a recovery. This equates to a 5-18% expected return for 2023 when including dividends. The low end of the range assumes that revenue growth, profit margins, and price-to-earnings multiples trend toward long-term (20-30 year) averages while the higher end of the range assumes that these factors remain closer to their 5-year averages. Of course, a significant recession (which is not our base case expectation) would likely lead to the S&P 500 underperforming this expectation. Many other parts of the market have been more depressed or dislocated, and could see even greater recoveries in 2023. Below we provide color on themes that are being actively expressed in portfolios, and our research team is reviewing other thematic investments in the areas of security (energy, inflation, food), renewable energy, electrification of vehicles, robotics / automation, and artificial intelligence that could be expressed in portfolios in 2023.

Health Care Innovation

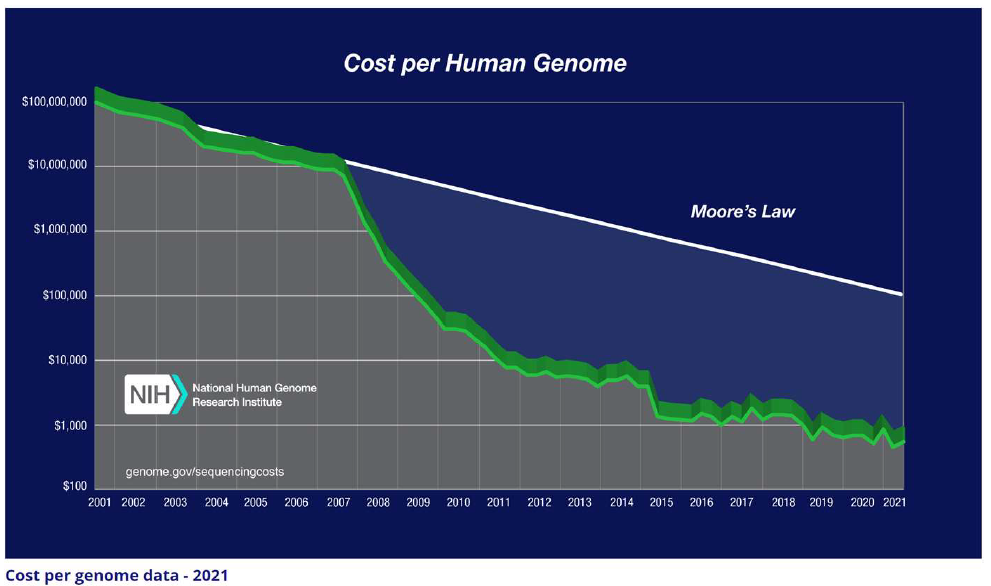

Precision medicine, commercial genetic tests, wearable diagnostic devices, gene editing, mRNA vaccine technology – the breadth and pace of health care innovation is difficult to articulate. Beginning with the Human Genome Project in 2003, a project which took 13 years to sequence 92 percent of the genome at a staggering cost of nearly three billion dollars, the idea that medicine needn’t be a generalized-for-the-masses industry, but rather a precision solution tailored to the individual, began to take root.4

Powered by rapid advancements in computing power and artificial intelligence (AI) that can detect patterns in complex genomics data sets (for more on AI, see the Disruptive Technology section below), the cost and time required to sequence the genome has plummeted over the past two decades (see graphic).5 The potential applications include things that would have sounded like science fiction even a decade ago. We believe this innovation has the potential to benefit society and economic growth as we extend lifespans and keep people active later into life. We also believe the current environment represents an attractive entry point for long-term investors.

“I believe that aging is a disease. I believe it is treatable. I believe we can treat it within our lifetimes. And in doing so, I

believe, everything we know about human health will be fundamentally changed.”6

-Dr. David Sinclair

Disruptive Technology

Much like health care innovation, artificial intelligence, cloud computing, advanced robotics, autonomous vehicles, digital wallets, and block chain technologies are disrupting industries across the global economy. Innovation is often thought of as technology sector specific, but advancements have the potential to impact everything from farming (precision farming driven by AI) and manufacturing (3D printing) to gaming (virtual reality) and bridge inspections (drone technology).7 8

Disruptive technology stocks, driven in part by investment firms like ARK Invest, accelerated upward much more steeply than traditional stocks during the Covid-19 rebound (for example, see the ARK Innovation ETF, blue line, versus the S&P 500 index at right). However, as inflation surged in 2022, companies focused on innovative technology found themselves in the eye of the storm and have retreated to a much greater degree than broader equity indexes. Again, we believe this represents an attractive entry point for long-term investors.

We look forward to the privilege of stewarding your wealth in 2023 in this beautiful and ever-evolving craft that we call investing. The year will very likely be more fun than the last. New and unexpected challenges will come, but so will opportunities. Thank you for your trust and confidence in our management as we embark on a new year.

Outlook & Positioning Summary

Economy

The US labor market has been a key pillar of strength that is likely supporting household confidence in spending as well.

Inflation has begun to show signs of softening (notably home and energy prices), which has led to an easing of current and expected future financial conditions.

Valuation

Stocks and bonds, on average, appear fairly valued today, but beneath the surface there may be many pockets of opportunity created by violent upheaval in markets during 2022.

Technical

Stocks have attempted to re-enter a long-term uptrend multiple times in 2022, but none have been sustainable thus far. Investor sentiment remains very bearish which has historically indicated a potentially good buying opportunity.

Positioning

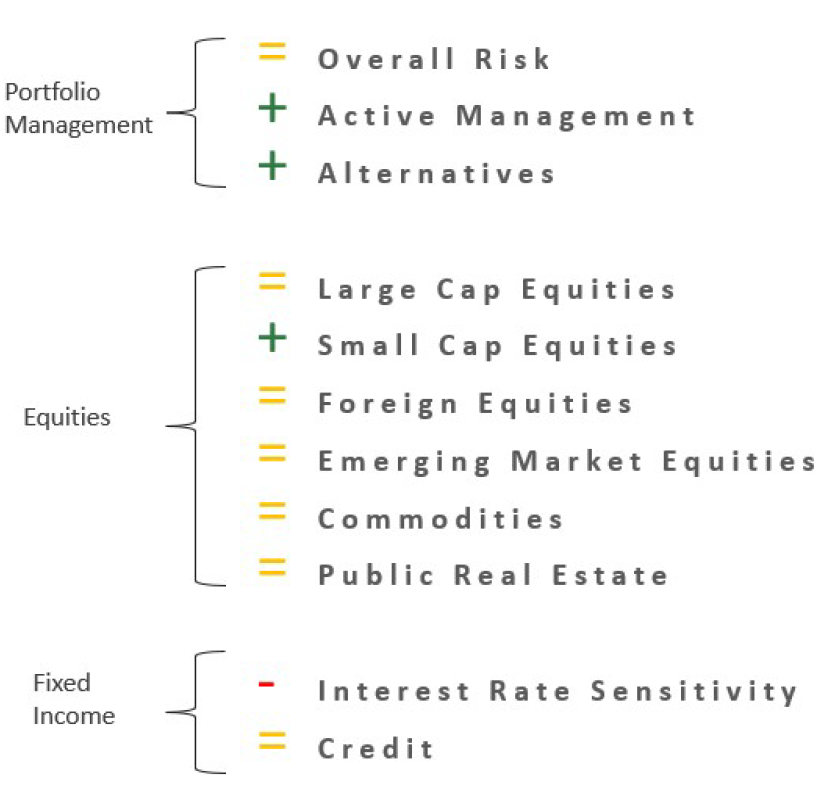

Overall risk versus targets neutral as markets do not appear overly cheap or expensive and economy may be entering a “muddle through” period.

Favor active management and flexible alternative strategies as market volatility may have created pockets of opportunity beneath the surface.

Overweight US small cap stocks as recession fears may be overblown.

Remain cautious on interest rate sensitive investments while Fed continues to increase interest rates, but actively working now to reduce past underweight that benefited portfolios in 2022.

Prices & Interest Rates

| Representative Index | Year-End 2022 | Year-End 2021 |

|---|---|---|

| Crude Oil (US WTI) | $80.26 | $75.21 |

| Gold | $1,819 | $1,828 |

| US Dollar | 103.52 | 95.97 |

| 2 Year Treasury | 4.41% | 0.73% |

| 10 Year Treasury | 3.88% | 1.52% |

| 30 Year Treasury | 3.97% | 1.90% |

Asset Class Returns

| Category | Representative Index | 2022 | 2021 |

|---|---|---|---|

| US Large Cap Equity | S&P 500 | -18.1% | 28.7% |

| US Large Cap Equity | Dow Jones Industrial Average | -6.7% | 21.0% |

| US All Cap Equity | Russell 3000 Growth | -29.0% | 25.9% |

| US All Cap Equity | Russell 3000 Value | -8.0% | 25.4% |

| US Small Cap Equity | Russel 2000 | -20.4% | 14.8% |

| Global Equity | MSCI All-Country World | -18.4% | 18.5% |

| Global Equity | MSCI All-Country World ESG Leaders | -20.0% | 20.8% |

| Foreign Developed Equity | MSCI EAFE | -14.5% | 11.3% |

| Emerging Market Equity | MSCI Emerging Markets | -20.1% | -2.5% |

| US Fixed Income | Bloomberg Barclays US Agg. Bond | -8.5% | 1.5% |

| US Fixed Income | Bloomberg Barclays Municipal Bond | -13.0% | -1.5% |

| Global Fixed Income | Bloomberg Barclays Global Agg. Bond | -16.3% | -4.7% |

1 Source: Investment Strategy Group, Bloomberg based on 14 historical episodes since 1945.

2 Source: BLS, FactSet, J.P. Morgan Asset Management. Heatmap shading is relative to the two-year period shown. Component weights may not add to 100. OER

refers to owner’s equivalent rent.

Guide to the Markets – U.S. Data are as of December 31, 2022.

3 Source: JPMorgan Asset Management

4 Source: Human Genome Project Fact Sheet3 Source: JPMorgan Asset Management

5 Source: The Cost of Sequencing a Human Genome

6 Source: Lifespan by Dr. David A. Sinclair, Co-director of Paul F. Glenn Center for Biology of Aging Research at Harvard Medical School

7 Source: ARK Big Ideas for 2021

8 Source: JPMorgan Asset Management